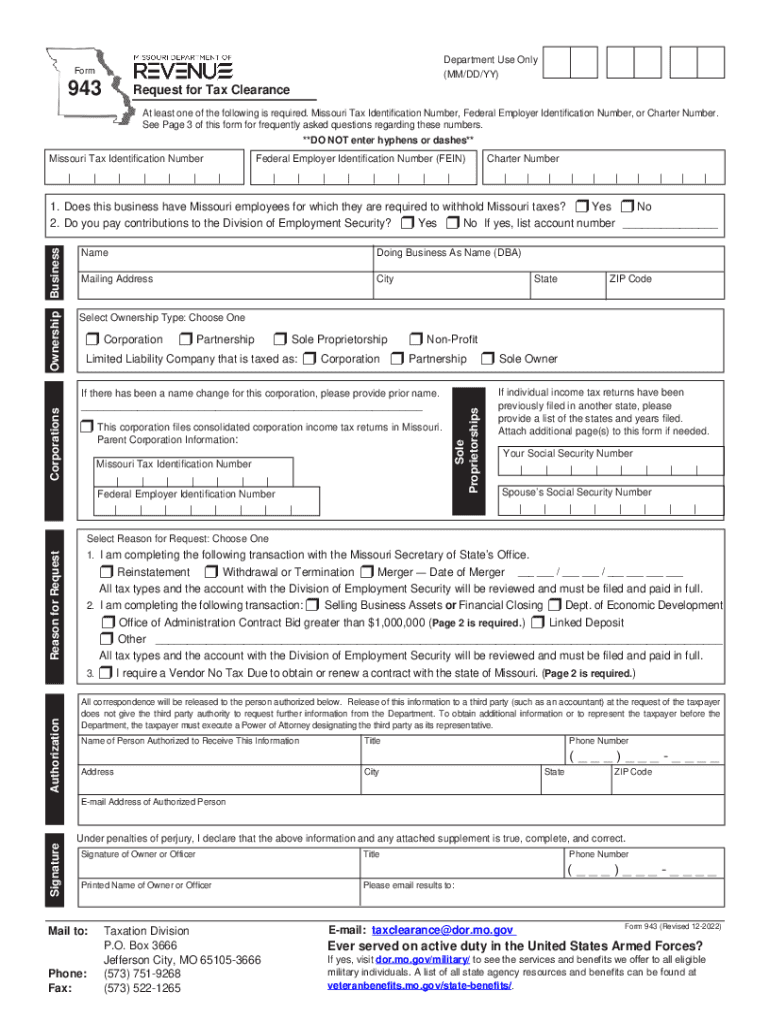

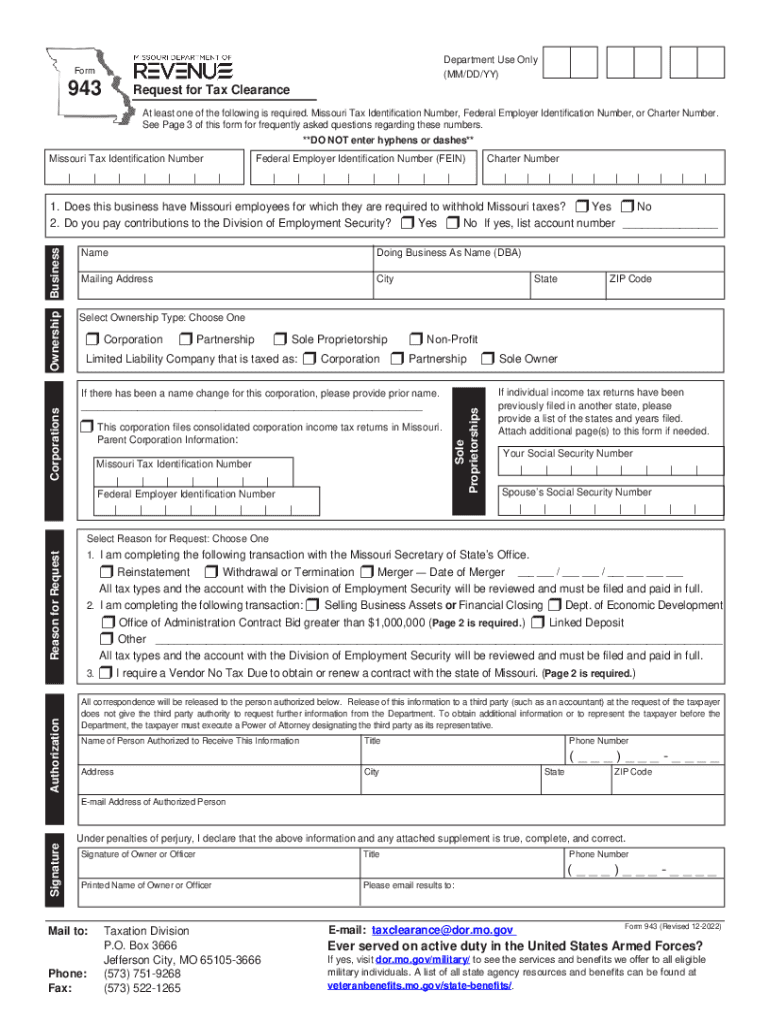

MO DoR 943 2022-2024 free printable template

Get, Create, Make and Sign

Editing form 943 missouri online

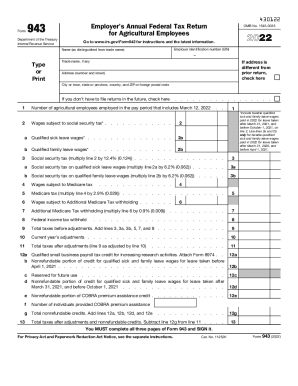

MO DoR 943 Form Versions

How to fill out form 943 missouri 2022-2024

How to fill out tax return filing:

Who needs tax return filing:

Video instructions and help with filling out and completing form 943 missouri

Instructions and Help about missouri tax clearance form

Hello and welcome to this Fallon tutorial today we are going to look at how to apply for a tax clearance certificate usually that's a document that's often requested by certain businesses to do transactions with you or that some organizations will need if you want to apply for membership and things like that, so I think it's very important to know how to get your tax clearance certificate so once you've logged on onto your affine profile you can actually click on this on the right-hand side this is two arrows that you can click on at all actually expand the profile to you so you can, you'll see is more space to work with so on the left hand side top left-hand side you've got home returns services and tax status you can actually go into tax status, and I've already done to've redone the activation process but if yours is an activated each you have to click on activation tick both tax compliance status and the disclaimer click continue and click continue until you get to this point where you see this the screen the tax compliance profile you'll be able to get to this point and when you're here this is the important check say if the check, and it's my registration compliant is you know issues with that do I have any outstanding returns do I have any date that's Duty sauce and do I have any supporting documents outstanding and if your is all of those are update then you can get a tax clearance certificate and sauce will issue it immediately if you are one of these status are non-compliant you can actually go into the submission of returns, and it will drop, and then you can see okay so my the loss tax return is due the 2017 tax return must be submitted that's why I'm non-compliant, or we back and there's an amount here you can open it up, and you can see where the weights from okay these taxpayers a hundred percent clear so in order to apply for a tax lien certificate you need to click on tax compliance status request select good standing, and then you request it let's go do that I'm going to enlarge it, so you put in some contact detail you actually only have to fall in one of the numbers we don't have to follow and follow everything is this request completed another done by authorized representative on behalf of the taxpayer now this is a taxpayer himself and then this is not a partnership or joint venture if you take yes you have to complete a representative taxpayer details or tax practitioner details but because this is an individual profile this is actually done by the taxpayer himself okay, so everything is filled out there's no other required field, so I can just submit continue a nigra so as you can see every done one, but you'll notice at that it's compliant it's been approved I select the one I want, and I'll click print TCC to download TCS later that's what it's called when it's downloaded and as you can see tax lien certificate good standing, and it's issued free of charge passes and that's it, and it expires next year this time next...

Fill missouri paycheck : Try Risk Free

People Also Ask about form 943 missouri

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 943 missouri 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.